Written by : NGDlover

Notegolddiamond - With the improvement in rules, systems and open application of every country, the black capitalists, the corruptor, the criminals and even the terrorists , will be more difficult to act and move their fund freely. But that's also the reason why the money from every activities that violate the law is controlled from some place in the world which strictly upholding the secrecy in every aspect of their economic rules.

Mr. Crab " Well well well...Tom my friend, dont buried your money in your backyard ! Instead , you have to put it your money to the bank. Then you should go to some great country to make account, and transfer your money into it. After that, look for some business around the world and place your money there. I guarantee, you can make a lot of clean money by that way.....I can help you to put it on the banks, so you can go abroad soon. The rest of your cases here, let your lawyer do the best for you...."

Mr.Tom " Thanks Mr.Crab. However, You should help me now....."

Mr.Crab singing "....money...money.... I love money..."

Here I invite you to make a virtual trip to the 15 World Most Comfortable for Capital in the world (tax havens region), based from a report entitled "Financial Secrecy Index" made by Tax Justice Network (TJN), an independent organization dedicated to high-level research, analysis and advocacy in the field of tax and regulation, presented for you by notegolddiamond.blogspot.com,. Update 2009.

Netherlands, Opacity 58, Finance Secrecy (Tax Haven) Rank 15

Guernsey, Opacity 79, Finance Secrecy (Tax Haven) Rank 13

photo: theoghhotel.com

Austria, Opacity 91, Finance Secrecy (Tax Haven) Rank 12

Jersey, Opacity 87, Finance Secrecy (Tax Haven) Rank 11

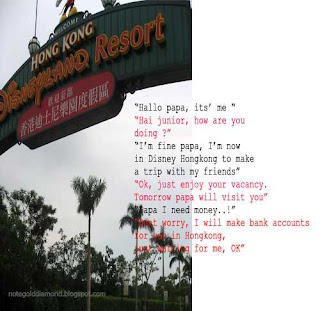

Hong Kong, Opacity 62, Finance Secrecy (Tax Haven) Rank 10

Belgium, Opacity 73, Finance Secrecy (Tax Haven) Rank 9

virtualtourist.com

Singapore, Opacity 79, Finance Secrecy (Tax Haven) Rank 8

Bermuda, Opacity 92, Finance Secrecy (Tax Haven) Rank 7

Ireland, Opacity 62, Finance Secrecy (Tax Haven) Rank 6

London, Opacity 42, Finance Secrecy (Tax Haven) Rank 5

photo:nela444

Cayman Islands, Opacity 92, Finance Secrecy (Tax Haven) Rank 4

Switzerland, Opacity 100, Finance Secrecy (Tax Haven) Rank 3

Photo : gladysongphoto: theoghhotel.com

Austria, Opacity 91, Finance Secrecy (Tax Haven) Rank 12

Jersey, Opacity 87, Finance Secrecy (Tax Haven) Rank 11

Belgium, Opacity 73, Finance Secrecy (Tax Haven) Rank 9

virtualtourist.com

Singapore, Opacity 79, Finance Secrecy (Tax Haven) Rank 8

Bermuda, Opacity 92, Finance Secrecy (Tax Haven) Rank 7

Ireland, Opacity 62, Finance Secrecy (Tax Haven) Rank 6

photo:nela444

Cayman Islands, Opacity 92, Finance Secrecy (Tax Haven) Rank 4

Switzerland, Opacity 100, Finance Secrecy (Tax Haven) Rank 3

Luxembourg, Opacity 87, Finance Secrecy (Tax Haven) Rank 2

Delaware (USA), Opacity 92, Finance Secrecy (Tax Haven) Rank 1

Key :

1. Allow near total or absolute anonymity to those who own and run companies. It is almost impossible to tell where these companies do actually trade, and where they should have tax liability or be subject to regulation

Key :

1. Allow near total or absolute anonymity to those who own and run companies. It is almost impossible to tell where these companies do actually trade, and where they should have tax liability or be subject to regulation

2. Contribution of the financial services sector to the overall economy. Such influence can undermine democratic decision making processes, can facilitate corruption, in the case of financial services can create a strong orientation towards the needs of those outsides the territory who would not normally be the prime concern of its government, and can be (but we stress, is not always) conducive to a criminogenic environment.

3. A high proportion of people working in financial services in the overall economic activity of a country is likely to indicate the existence of considerable political influence by the financial services industry on the government

SOME NOTE FROM G-20 MEETING

Agreed urged an effort to standardize rules for accounting, rules for hedge funds which is not easily does, and rules regarding Tax Heaven.

Agreed that banking confidentiality issues should be terminated and no more tolerance for the state or territory which protect the tax avoidance and other white-collar crime.

Agreed to exclude and isolate the tax haven countries from each international institutions, especially in finance and banking.

[Virtual Trip To World Most Comfortable Place for Capital (Tax Havens)]

Source : http://www.taxjustice.net/, kompas, visibiznews.

notegolddiamond.blogspot.com archives

KITCO live gold price

KITCO live gold price

Gold Price in Japan

Gold Price in Japan

Harga emas Aneka Tambang

Harga emas Aneka Tambang

4 comments:

Wow! You have managed to transform a very helpful thought into reality. I was looking for someone who could help me in managing my assets. And your site has everything I needed. for my asset protection. Not only your site but also your marketing team is very helpful to me. I thank you for that. Tax haven

Thank you .your website is quite helpful to me. I liked the theory of billionaire’s loop hole. And your logic of anonymous transactions, It shows how to avoid taxes legally. Thanks guys. Tax havens

Hey! Thanks for your company’s instant help. Otherwise I would have lost my assets and wealth. I liked your solutions very much. Your company’s employees are so professional that they heard my problems and gave me solutions instantly. They also taught me about. I refer others to try this website to solve their problems in a satisfactory way. Thanks again. tax havens

Paylaşımınız için teşekkürler. Paylaşımlarınızın devamını dilerim yazılarınızı takip ediyorum teşekkürler.

Post a Comment